payday loan advance no credit check

8.Why does a mortgage Provide Connect with Taxation? [Completely new Blogs]

It is very important remember that each one of these solutions has its own own number of positives and negatives. For example, an unsecured loan could have a high interest than just good home loan, while you are advance payment advice apps may have earnings constraints and other qualifications conditions. It is critical to weighing all choice before you make good decision.

In terms of gifting home financing, there are factors to keep in mind. One of the most important is where brand new provide tend to apply to fees for the giver in addition to individual. New effect out of a mortgage gift with the taxes can vary created towards the multiple products, like the number of the fresh new gift in addition to matchmaking involving the giver and person. Inside area, we will explore the brand new tax ramifications of a loans Shelby home loan present and offer certain helpful information to keep in mind.

When you’re the fresh new giver away from home financing current, you ought to be aware of the yearly provide taxation exclusion. Not as much as latest taxation laws, you can give-up so you can $15,000 per year so you can as many people as you wish instead causing gift income tax. When you find yourself hitched, you and your spouse normally per surrender in order to $15,000 a-year, to own all in all, $31,000 for every single receiver. This means that when you find yourself providing a home loan current out of $50,000 into youngster and their lover, you could potentially avoid provide tax from the splitting the gift for the a couple $25,000 gift suggestions – one to away from you and something from the spouse.

Whether your financial present is higher than this new annual gift taxation exclusion, you might still have the ability to stop provide income tax that with everything present income tax different. This exception enables you to provide a lot of money more than your lifetime as opposed to taking on present tax. To have 2021, this new existence current tax exception are $eleven.7 billion per person. As a result if you render a mortgage present out-of $100,000, you should use $15,000 of your own yearly gift tax exemption and apply the remainder $85,000 toward life provide income tax difference.

If you are new receiver of a mortgage present, you are wanting to know whether you can easily deduct the fresh new home loan attention on your own income tax go back. Fortunately you to provided the borrowed funds are in your name and you are the only making the payments, you should be capable subtract the borrowed funds focus on your own tax go back, even when the current came from others.

To put it briefly, gifting a home loan can have income tax effects for the giver therefore the receiver. By knowing the annual current income tax exemption, lifestyle gift taxation different, and you can financial interest deduction, you might let make sure that your financial gift can be income tax-productive that you can.

nine.Faq’s from the Mortgage Current Emails [Totally new Website]

In terms of getting home financing, there are many points to consider. One to essential requirement ‘s the financial provide letter, that is a page away from a relative or pal exactly who are gifting you currency to make use of to your down-payment. While this appears like a simple processes, you will find have a tendency to of many inquiries one arise. To help express certain misunderstandings, we’ve got gathered a list of Faq’s on mortgage provide characters.

But not, in the event your present received for you when it comes to a loan, you won’t be able to deduct the attention on the taxation get back

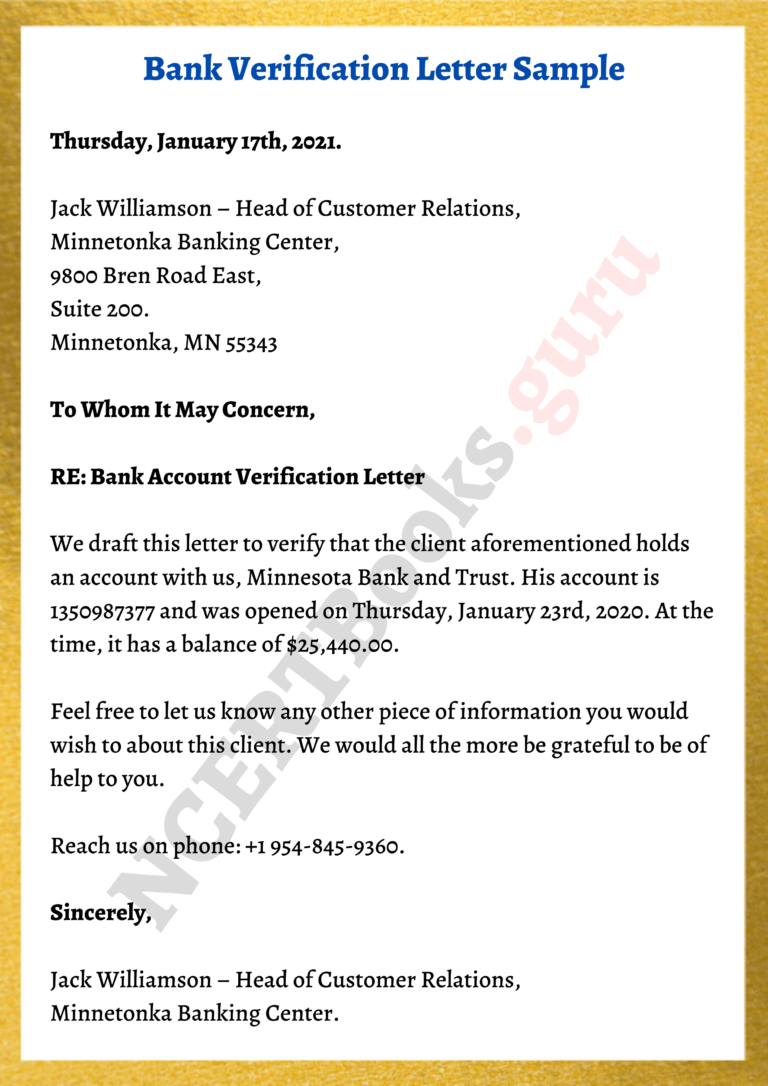

Home financing current page is actually an authored statement out-of children associate or pal who’s providing currency to use into their down-payment towards the a property. The fresh new page normally comes with the name of the giver, the degree of the fresh new provide, and you may an announcement the cash is a present and never financing.