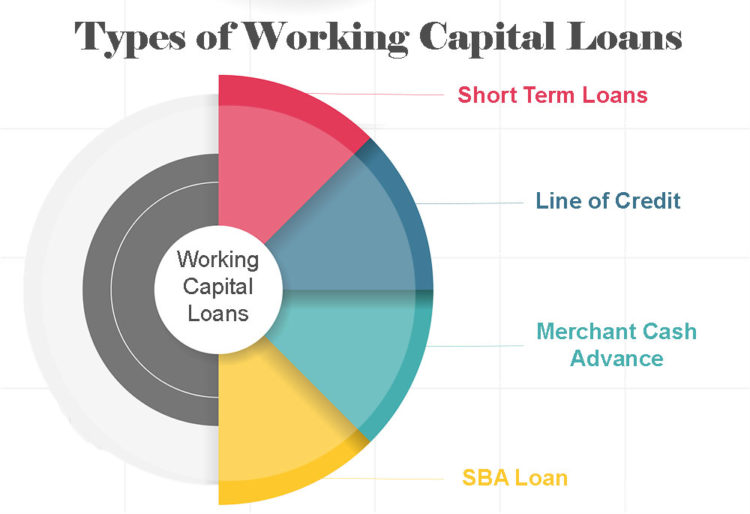

why get a cash advance

The brand new GSE guarantee transmits the credit exposure (i

Version of MBS

This new securitization procedure can take multiple variations, however, about three wider categories was demonstrated lower than: Federal national mortgage association and you may Freddie Mac computer, Ginnie Mae, and personal-identity securitization (PLS). The root finance that comprise the fresh new MBS is related to the fresh new financial classifications described inside the «The primary Business» part of this report: fundamentally, conforming mortgages are included in Federal national mortgage association and you may Freddie Mac MBS, government-covered mortgage loans for the Ginnie Mae MBS, and you will nonconforming mortgage loans independently-identity MBS, even though there is actually conditions. 27

When mortgage loans are securitized, traders essentially undertake the risks of mortgage loan, for example borrowing from the bank exposure and prepayment exposure. not, sometimes, an entity except that the fresh individual you are going to ensure the MBS, in which particular case new organization providing the guarantee takes on the new credit chance if you’re investors happen the risks for the rising and you can dropping interest rates. Dealers for the Federal national mortgage association, Freddie Mac, and Ginnie Mae MBS do not happen credit exposure due to this new pledges men and women organizations promote, but PLS investors and you can people out-of low-protected mortgages are exposed to borrowing from the bank exposure.

Federal national mortgage association and you will Freddie Mac computer

From inside the Higher Anxiety, Congress authored Fannie mae (commercially, the brand new Federal national mortgage association, otherwise FNMA) given that a federal government agencies so you’re able to prompt home loan credit. twenty-eight In the 1968, Congress divided Federal national mortgage association for the two-fold: (1) a national company, the government National Mortgage Association (or Ginnie Mae) and you will (2) a government-sponsored business that chose title Federal national mortgage association. When you look at the 1970, Congress situated Freddie Mac computer (commercially, the newest Government Mortgage Mortgage Agency, otherwise FHLMC) within the Government Home loan Bank system, owned by representative financial institutions.

Federal national mortgage association and Freddie Mac do not originate mortgage loans, a procedure that takes place in an important market. Alternatively, new GSEs get conforming mortgages, which fulfill its qualifications requirements. The GSEs sometimes keep the mortgages in their portfolios or pool the fresh new mortgages into the MBS, which are offered to help you buyers or hired from the GSEs because the opportunities. The new GSEs guarantee that dealers throughout these MBS can get fast percentage from dominating and you will interest even if the borrower becomes delinquent to the hidden home loan. age., the risk one to some consumers you are going to default and not pay the mortgages) from the investors on the GSEs. To compensate the new GSEs for their be sure, the new GSEs discovered a promise commission. The newest GSE make certain helps make their MBS more quickly traded and worthy of so much more so you’re able to buyers, expanding investors’ interest in GSEs’ MBS. The support provided by GSEs on secondary market can also be change to lower prices having individuals in the primary business. 31

One another Federal national mortgage association and Freddie Mac computer is actually private companies, although both enjoys congressional charters containing special privileges and you can specific special duties to support affordable houses to possess lower- and moderate-money properties. Because personal businesses, their staff are not bodies teams, in addition to their costs is actually explicitly perhaps not backed by government entities. Regardless of the specific disclaimer, it actually was are not thought that the us government perform, indeed, straight back new GSEs if required. Within the , Federal national mortgage association and you may Freddie Mac were into the tall monetary complications and you will offered to be put in the volunteer conservatorship, that enables the us government to operate all of them. New said requires of your own conservatorship are to work at the brand new GSEs in ways that fulfill the social coverage needs, rescue brand new enterprises’ possessions, and you will get back them to shareholder control or break down them via receivership. 30

Ginnie Mae

Congress based Ginnie Mae when you look at the 1968 when it separated Fannie mae toward a couple independent organizations https://paydayloanalabama.com/emelle/. Ginnie Mae stays an authorities company included in the Company out of Casing and you can Urban Advancement.

Ginnie Mae claims MBS made up solely out of mortgage loans insured otherwise secured because of the government, namely FHA, Virtual assistant, USDA, or HUD’s Workplace out of Social and you will Indian Homes. Just as the GSEs, Ginnie Mae claims traders within its MBS timely payment regarding dominating and you can focus payments in exchange for a vow commission. Giving a holiday market for authorities-supported mortgage loans, Ginnie Mae advances the quantity of investment for sale in an important market for lenders to give authorities-supported mortgages. As opposed to Federal national mortgage association and you will Freddie Mac computer, Ginnie Mae will not purchase or securitize mortgages; instead, it guarantees the brand new MBS given by the certain issuers (including finance companies otherwise credit unions) which were passed by Ginnie Mae. Also, Ginnie Mae’s employees are regulators teams, and its particular guaranty are clearly backed by an entire trust and you can borrowing of your You.S. government. Because of this, in the event that Ginnie Mae were not able to meet up with the obligations, their MBS buyers could well be repaid regarding the U.S. Treasury funds.